Unknown Facts About Eb5 Investment Immigration

Wiki Article

The 3-Minute Rule for Eb5 Investment Immigration

Table of ContentsWhat Does Eb5 Investment Immigration Mean?More About Eb5 Investment Immigration4 Easy Facts About Eb5 Investment Immigration DescribedEb5 Investment Immigration Fundamentals ExplainedHow Eb5 Investment Immigration can Save You Time, Stress, and Money.

While we aim to provide precise and current content, it needs to not be taken into consideration lawful suggestions. Migration laws and guidelines undergo alter, and individual situations can vary commonly. For customized guidance and lawful advice regarding your certain immigration circumstance, we highly recommend speaking with a certified migration attorney who can offer you with customized assistance and guarantee compliance with present laws and policies.

Citizenship, through investment. Currently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Employment Locations and Backwoods) and $1,050,000 in other places (non-TEA zones). Congress has approved these amounts for the next 5 years beginning March 15, 2022.

To receive the EB-5 Visa, Financiers have to develop 10 full-time united state jobs within two years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that investments contribute straight to the U.S. work market. This uses whether the tasks are created straight by the company or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

All about Eb5 Investment Immigration

These jobs are established through designs that make use of inputs such as growth prices (e.g., building and construction and devices expenses) or annual earnings created by recurring procedures. On the other hand, under the standalone, or direct, EB-5 Program, only straight, full time W-2 staff member settings within the company might be counted. A vital risk of relying solely on straight employees is that personnel reductions because of market problems might result in inadequate full time settings, potentially resulting in USCIS denial of the investor's petition if the work production demand is not met.

The financial model then predicts the variety of direct jobs the new business is most likely to create based on its anticipated incomes. Indirect tasks determined through financial versions describes work generated in industries that supply the items or solutions to the business straight involved in the project. These work are developed as a result of the boosted need for items, materials, or solutions that sustain the service's operations.

Eb5 Investment Immigration Things To Know Before You Buy

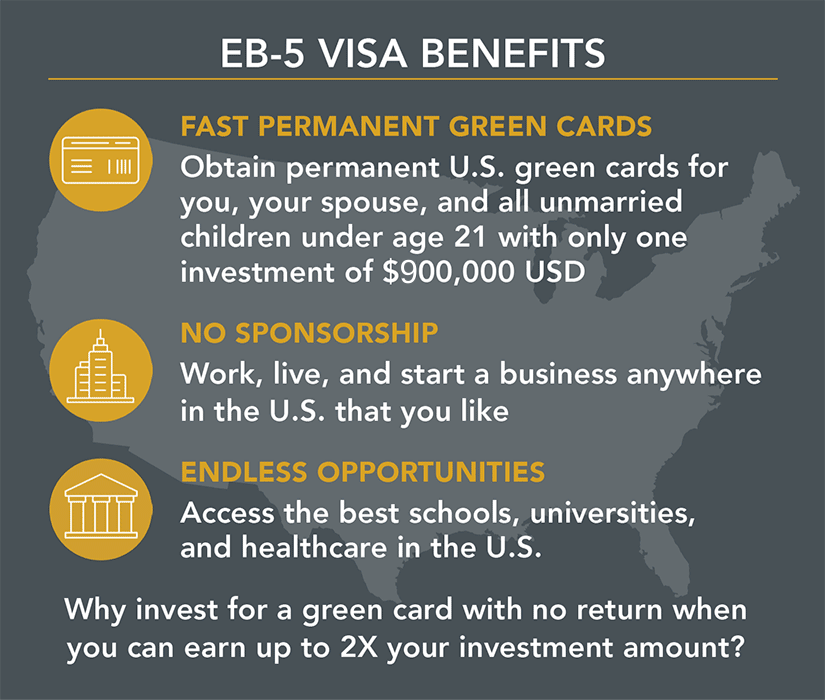

An employment-based 5th choice classification (EB-5) investment visa offers a technique of ending up being an irreversible united state citizen for foreign nationals wishing to invest resources in the USA. In order to request this environment-friendly card, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and produce or protect at the very least 10 full time tasks for USA workers (omitting the investor and their immediate household).

This procedure has been a significant success. Today, 95% of all EB-5 capital is increased and invested by Regional Centers. Considering that the 2008 monetary crisis, accessibility to resources has been tightened and metropolitan budget plans remain to deal with substantial shortfalls. In many regions, EB-5 financial investments have actually loaded the financing space, supplying a new, important resource of capital for regional economic development jobs that renew communities, produce and support jobs, facilities, and solutions.

Eb5 Investment Immigration for Dummies

employees. In addition, the Congressional Spending Plan Workplace (CBO) racked up the program as profits neutral, with management prices paid for by applicant costs. EB5 Investment Immigration. Even more than 25 nations, consisting of Australia and the United Kingdom, usage similar programs to bring in international financial investments. The American program is a lot more rigid than lots of others, calling for substantial risk for investors in regards to both their monetary investment and immigration standing.Family members and individuals that seek to relocate to the USA on a long-term basis can make an application for the EB-5 Immigrant Financier Program. The USA Citizenship and Immigration Services (U.S.C.I.S.) laid out numerous needs to get long-term residency through the EB-5 visa program. The requirements can be summed up as: The financier should meet capital expense quantity demands; it is commonly called for to make either a $800,000 or $1,050,000 capital expense quantity right into an U.S.

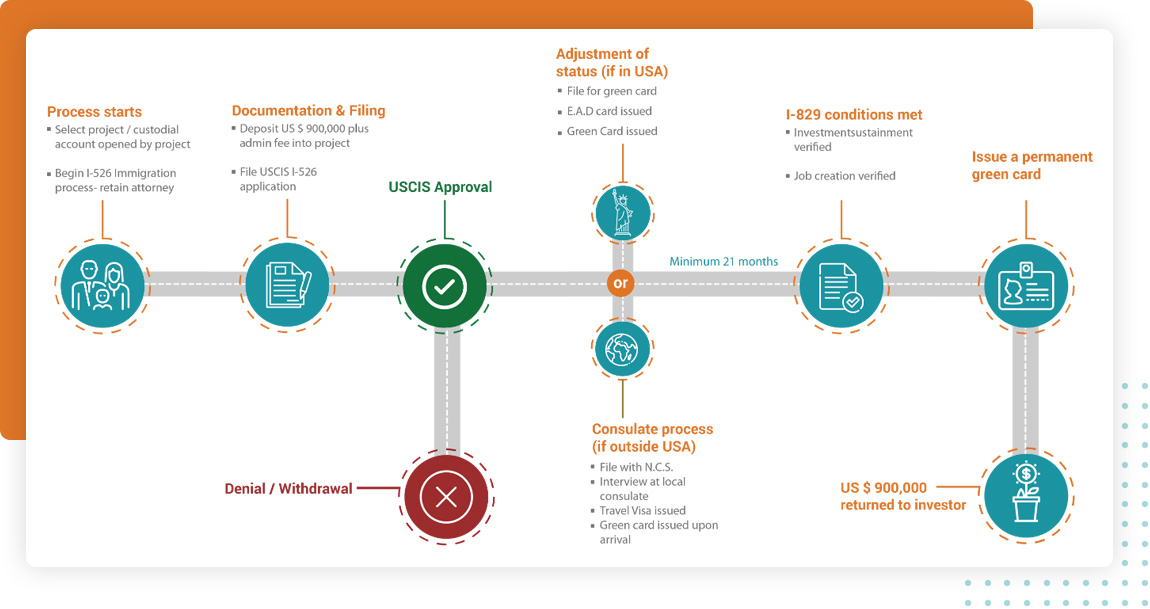

Talk with a Boston migration lawyer regarding your requirements. Right here are the general steps to getting an EB-5 financier eco-friendly card: The initial step is to find a certifying investment opportunity. This can be a brand-new company, a regional center task, or an existing service that will certainly be broadened or reorganized.

When the chance has actually been determined, the investor needs to make the investment and send an I-526 petition to the U.S. Citizenship and Migration Solutions (USCIS). This petition must article source include evidence of the investment, such their website as financial institution declarations, purchase agreements, and company plans. The USCIS will examine the I-526 application and either accept it or request additional evidence.

The Single Strategy To Use For Eb5 Investment Immigration

The investor has to look for conditional residency by submitting an I-485 petition. This request should be sent within 6 months of the I-526 approval and should include evidence that the investment was made and that it has actually developed a minimum of 10 permanent tasks for united state employees. The USCIS will certainly evaluate the I-485 application and either approve it or request additional evidence.Report this wiki page